what is the tax rate in tulsa ok

Any wages above 147000 is not taxed. Combined with the state sales tax the highest sales tax rate in Oklahoma is 115 in the city of Boley.

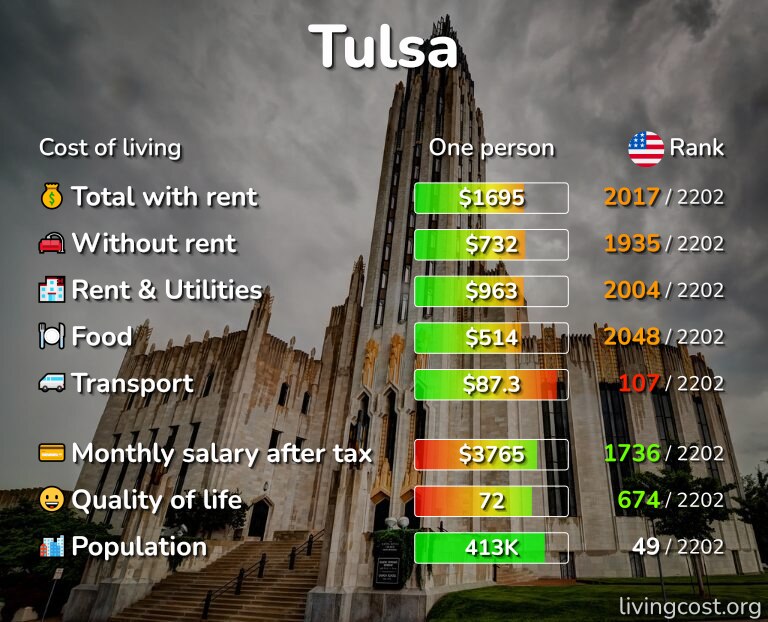

Tulsa Ok Cost Of Living Salaries Prices For Rent Food

This is the total of state county and city sales tax rates.

. There are 2 FICA taxes. Tulsa OK Sales Tax Rate. Some cities and local governments in Tulsa County collect additional.

Tulsa County collects on average 106 of a propertys assessed fair market value as property tax. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

Has impacted many state nexus laws and sales tax collection requirements. 2021 Tulsa County Tax Rates. Sand Springs OK Sales Tax Rate.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. The Oklahoma sales tax rate is currently. Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766.

The countys average effective property tax rate of 113 is above both the state average of 087 and the national average of 107. Ponca City OK Sales Tax Rate. The Tulsa County Sales Tax is 0367 A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

How much is tax by the dollar in Tulsa Oklahoma. The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022. Average Property Tax Rate in Tulsa County Based on latest data from the US Census Bureau Tulsa County Property Taxes Range.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The current total local sales tax rate in Tulsa OK is 8517. The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200.

Sapulpa OK Sales Tax Rate. Did South Dakota v. Detailed Oklahoma state income tax rates and brackets are available on this page.

The Oklahoma state sales tax rate is currently. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. Like the majority of the nation Oklahoma has a progressive state income tax system.

The current total local sales tax rate in Oklahoma City OK is 8625. What is the sales tax rate in Tulsa Oklahoma. Tax rates sometimes referred to as millage rates are set by the Excise Board.

Situated along the Arkansas River in northeast Oklahoma Tulsa County has the second highest property tax rates in the state. Tax rate of 475 on taxable income over 12200. Click here for a larger sales tax map or here for a sales tax table.

Other local-level tax rates in the state of Oklahoma are quite complex compared against local-level tax rates in other states. Depending on local municipalities the total tax rate can be as high as 115. For the Single Married Filing Jointly Married Filing Separately and Head of Household filing statuses the OK tax rates and the number of tax brackets remain the same.

The Tulsa County sales tax rate is. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. Exact tax amount may vary for different items.

If you are thinking about becoming a resident or just planning to invest in Tulsa County real estate youll come to know whether the countys property tax rules are favorable for you or youd prefer to look for another place. Yearly median tax in Tulsa County. How much are taxes in Tulsa County.

There is no applicable special tax. 608 rows There are a total of 469 local tax jurisdictions across the state collecting an average local tax of 4247. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

County of Tulsa 2021 Levies Detail. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. The December 2020 total local sales tax rate was also 8517.

Oklahoma has 762 special sales tax. The Tulsa sales tax rate is. Norman OK Sales Tax Rate.

The Oklahoma OK state sales tax rate is currently 45. Oklahoma City OK Sales Tax Rate. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax.

Taxes are based upon budgets submitted by taxing jurisdictions and include the amounts necessary to pay bonded indebtedness approved by a vote of the people. State of Oklahoma 45 Tulsa County 0367 City 365. It has six tax brackets with rates ranging from 050 up to 500.

You can print a 8517 sales tax table here. Stillwater OK Sales Tax Rate. Owasso OK Sales Tax Rate.

Tulsa OK Sales Tax Rate. Overview of Oklahoma Taxes. The second is Medicare tax Pay FUTA taxes.

You have to match your employees contributions dollar-for-dollar. Your employees get to sit this one out. Tulsa County Oklahoma Property Tax Cleveland County The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of 106 of property value.

Shawnee OK Sales Tax Rate. Last updated June 2022 View County Sales Tax Rates. Oklahoma is ranked 972nd of the 3143 counties in the United States in order of the median amount.

The first is Social Security tax which is 62 of the first 147000 of taxable wages per year. 2483 lower than the maximum sales tax in OK. 2022 Oklahoma state sales tax.

The bracket you fall into will depend on your income level and filing. As the employer you also have to pay this tax. The 2018 United States Supreme Court decision in South Dakota v.

The exact property tax levied depends on the county in oklahoma the property is located in. Tax rate of 275 on taxable income between 7501 and 9800. Tulsa county collects the highest property tax in oklahoma levying an average of 134400 106 of median home value yearly in property taxes while cimarron county has the lowest property tax in the state collecting an average tax of 24400 043.

To review the rules in. Wayfair Inc affect Oklahoma. The County sales tax rate is.

Tax rate of 375 on taxable income between 9801 and 12200.

Tulsa Oklahoma Pictures Download Free Images On Unsplash

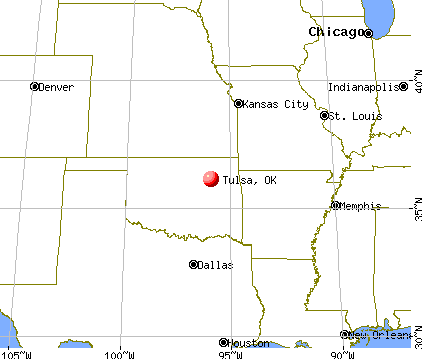

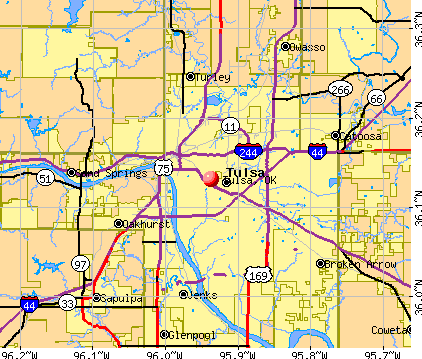

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1531 W 46th St Tulsa Ok 74107 Realtor Com

Here There Tulsa Oklahoma Decatur Magazine

2894 S Utica Ave Tulsa Ok 74114 Realtor Com

6011 E 57th St Tulsa Ok 74135 Realtor Com

Tulsa Oklahoma Pictures Download Free Images On Unsplash

The Plaza Shopping Center Price Edwards And Company

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1924 E Oklahoma Pl Tulsa Ok 74110 Realtor Com

Tulsa Oklahoma Will Pay You 10 000 To Move There And Work From Home

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Tulsa Oklahoma Pictures Download Free Images On Unsplash

20 Best Rehab Centers In Tulsa Ok Free Drug Alcohol Options

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

3226 E 62nd St Tulsa Ok 74136 Realtor Com